Overview of an IPO

Develop a broad understanding of the IPO process and discover tips about how to prepare for an IPO, including what major pitfalls to avoid.

Companies choose to go public for a variety of financial, strategic, and operational reasons. Common reasons are to gain capital to fund growth and to gain public shares for acquisitions. Because this process is expensive and complicated, it is important that companies analyze their specific situations when deciding whether to prepare for an IPO. The process involves several different parties with specific skillsets and consequently costs between 8 to 10 percent of the offering size. Usually, this amount falls between 2 and 5 million dollars. The IPO process usually takes about six months from the time the initial S-11 is filed.

Reasons for Going Public

Most often, companies go public to gain public shares to serve as currency for acquisitions. Additionally, private companies usually experience a significant increase in value after an IPO, helping them raise capital for internal growth more successfully. Public companies also enjoy greater investment liquidity for shareholders because there is an opportunity to sell shares quickly and easily. Lastly, companies go public to attract and retain talented employees, increase company prestige, and improve debt terms.

Deciding Whether Going Public Is the Right Decision

Though there are many advantages to going public, the process can also invite negative repercussions. In deciding to go public, private company owners forfeit a portion of future earnings, lose a portion of company control and profits, incur significant upfront and recurring expenses, and subject the company to public scrutiny and pressure. In addition, companies expose themselves to litigation risk, hostile takeovers, and restrictions on insider sales of company stock. When weighing the pros and cons of going public, companies should consider the strength of their management team, business plan, past financial success, competitive advantage, product offering, growth trajectory, and established controls. Alternatives to an IPO include a joint venture2, a reverse merger3, exempt offerings4, a sale to a strategic buyer or private equity firm, or continued private ownership. Please see our article IPO Advantages and Disadvantages, and Alternatives to an IPO for more guidance on what to consider when evaluating the IPO decision, as well as more detail on the alternatives.

Preparing for an IPO

Prior to beginning the formal IPO process, a company must prepare to function as a public company. Much of the preparation involves the company’s financial records. For example, the company must have historical financial statements audited according to Public Company Accounting Oversight Board (PCAOB) standards (as opposed to less stringent American Institute of Certified Public Accountants (AICPA) standards), complete with quarterly financial information (the process of compiling said information is often referred to as “quarterization”). The company must also develop financial projections. The underwriter, the financial institution supporting the IPO, will be interested in comparing past budgets with historical performance when analyzing these projections

.In addition to financial preparations, the company must create an internal IPO team. The team should include individuals from marketing, operations, and finance. The IPO team will be most successful if the CFO is familiar with the IPO process and if team members have public company experience. Expert assistance should also be secured with a law firm, accounting advisor, and independent auditor.

Prior to going public, companies must appoint independent5 directors. Major stock exchanges and markets require the majority of the board to be independent. In addition, an audit committee must be composed entirely of independent directors. Because of the increased scrutiny from shareholders and investors, it is also important that companies carefully evaluate their corporate governance practices and make improvements where necessary.

Key Participants and Expected Costs

The key participants in the IPO process, their basic roles, and their expected cost are listed below. It is worth noting that these participants comprise the full registration team. The costs listed below are estimates that will vary depending on firm, industry, and IPO complexity. Fees can dramatically increase if an IPO is particularly large or complex. For more detailed information on the costs of an IPO, please see our article Costs of Going Public.

*Other advisors (i.e. legal, public relations, etc.) can cost between $0 and $0.5 million.

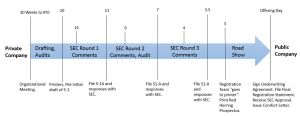

Sample Timeline and Process Overview of an IPO

Below is a sample timeline of an IPO with an accompanying narrative description of the process.

The formal IPO process begins six to twelve months prior to the IPO filing with the organizational meeting (sometimes called an All Hands Meeting). The IPO process usually takes five to nine months from the time of the organizational meeting to when the filing is declared effective. The organizational meeting is attended by all members of the registration team to discuss the nature of the IPO, establish a timeline, and coordinate responsibilities. This meeting should only be held if the external audit is nearly complete. One to two months after this meeting, the company will draft the initial S-1 form and file it with the SEC. Following the S-1 filing, the SEC will respond with comments requesting changes to the S-1. The company must then respond to the SEC’s comments and file an updated version of the S-1. This process will continue until all SEC comments are resolved.

It is important to note that the SEC has strict requirements that the financial statements included in the S-1 be current. These requirements demand that the process move quickly to avoid what is known as “stale data.”6 Specific regulation determines exactly when data becomes stale. For specific guidance on avoiding stale quarterly information, please see our article Drafting an S-1.

Once the S-1 is nearly complete, the registration team “goes to the printer,” meaning it meets to finalize the S-1 at the financial printer. The underwriter, the underwriter’s legal counsel, and the company’s senior management are major contributors at this meeting. Together they scrutinize the prospectus for any errors and finalize the legal language and grammar. Upon completion, the financial printer prints and distributes 5,000-10,000 physical copies to investors. Printers also file the S-1 electronically with the SEC through the EDGAR system. This version of the S-1 is the preliminary prospectus and is often called the red herring prospectus.

Once the preliminary registration statement is finished, the investment bank organizes the road show. This consists of a series of information meetings where company management pitches the company to institutional investors and other prospective stock buyers. Company presentations must be extremely well organized and orchestrated. Road shows vary by company in terms of creativity, audience engagement, and style. Meetings are held throughout the country for 8 to 10 days and additional meetings may occur internationally. The purpose of the road show is to generate interest in the IPO and gather information on what price investors would be willing to pay for the offering. The process of measuring investor demand for the IPO shares in order to determine a price is called the book building process.

After the road show is completed, the underwriters and board of directors determine a price at which the shares will be sold. While a price range is included in the preliminary S-1, the final price will be adjusted based on the perceived company value, industry dynamics, current market conditions, and the book building process. After a final price is determined, the investment bank and the company sign the underwriting agreement, and the S-1 is updated to include the adjusted price. This version of the S-1 is the final registration statement/prospectus. After the final prospectus is filed, the SEC determines whether the offering is effective. The auditor issues a final comfort letter documenting procedures performed at the request of the underwriter. Once the SEC declares the offering effective, the company is officially public and its shares become available for public sale on the chosen date.

Summary

Taking a company public is an involved and time-intensive process. This article gives a high-level overview of the IPO process, including reasons for going public, descriptions of the key participants, and what can be expected of the timeline and costs. In general, the formal IPO process requires about six months and will cost between 2 and 5 million dollars.

Resources Consulted

- The document used by companies going public to register securities with the SEC

- A business arrangement in which one company agrees to pool its resources with one or more parties, generally resulting in shared ownership, returns, risks, and governance

- A transaction in which a private company acquires a public company in order to avoid the time consuming and complex process of going public

- (Also called 144A offerings) a transaction in which unregistered securities are sold to sophisticated investors off an exchange and without stringent reporting requirements

- An independent director must not have a relationship with the company, its subsidiaries, or a related organization that would interfere with the ability to exercise independent judgment. Close family members of the director are also restricted from having a direct or indirect material relationship with the company

- When data is old enough that it no longer provides an accurate depiction of a company’s current financial operations and position