The Costs of Going Public

Understand the costs of going public. Common ways companies incur costs in an IPO, and provides an estimate of those costs.

The process of going public is a very big undertaking and deserves an appropriate amount of planning and attention several years prior to your intended filing date. Due to the arduous nature of filing with the SEC as a public company, the process can become very expensive. The following article will cover three main topics: first, the necessary services to plan for during the IPO process, and their relative costs; second, the structural changes that must be made before and after an IPO, and their relative costs; and third, the proper way to account for the costs discussed. For a discussion on weighing the costs and benefits of an IPO, turn to our IPO Advantages and Disadvantages article, which can help guide you in determining whether an IPO is right for your company. Furthermore, if you have questions regarding SEC and GAAP compliance after reading this article, take a look at our article on preparing for first-time GAAP audits.

The Costs

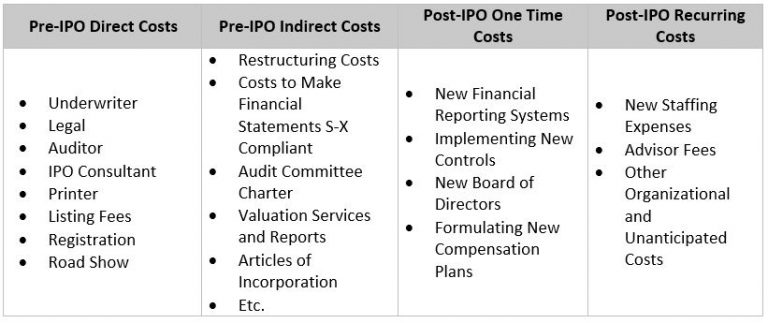

The costs of going public can be separated into four main categories; Pre-IPO direct costs, pre-IPO indirect costs, post-IPO one-time costs and post-IPO recurring costs. The specific costs in each of these categories are listed in the following table and are discussed in detail throughout the article.

Pre-IPO Direct Costs

Underwriter – Hiring an underwriter will generally cost between five and seven percent of the offering. The size of this commission is affected by the actual makeup of the security being sold, the industry of the company, the current state of the market, and the size of the offering, among other factors. Some of the biggest firms in this market are Credit Suisse, JP Morgan, Merrill Lynch, Morgan Stanley, and Goldman Sachs.

It is worth noting that when working with an underwriter, you have the option of several alternative methods for allocating shares to investors after the completion of a successful road show. Two commonly used methods are book building and auctions. Book building is the most commonly used; it is also seen as the safer of the two methods because an underwriter comes with an analyst that can provide a “buy” rating, making your company’s stock appealing to potential investors. This method does come with an additional risk of its own, however. According to a Forbes article by Jay Ritter—“Why Is Going Public So Costly?”—when there is more demand than supply at the current price, the underwriter may use its discretion to determine how the stock will be allocated among the institutional investors1. According to Ritter, due to the nature of the industry, underwriters are motivated to set the share price lower than necessary, and allocate a large portion of this underpriced offering to their favorite clients in return for a commission. This results in money being left on the table for the filing company, while the underwriters are making a healthy profit.

In contrast, Ritter states that in an auction “all investors who stated [during the roadshow] that they are willing to pay a price above the offer price receive shares, with underwriters having no discretion about who receives the shares.” In their paper titled “Why Don’t Issuers Choose IPO Auctions? The Complexity of Indirect Mechanisms,” Ravi Jagannathana, Andrei Jirnyi, and Ann Shermana explain that despite the fact that “auctions allow for price discovery while avoiding the potential conflict of interest between issuer and underwriter…” it is the difficulty of participating in auctions that dissuades investors from selecting an auction as their choice of stock allocation, thus “lead[ing] to investor behavior that is undesirable for the issuer.” In other words, auctions provide more assurance of fair prices, but the challenge of navigating an auction keeps investors away from them, which in turn drives issuing companies toward roadshows.

As you move forward with an IPO, be aware of the benefits and pitfalls of each method of IPO placement.

Legal – The fees required for your company’s outside counsel and the underwriter’s counsel are generally affected by the same factors listed above in the section on costs associated with underwriters, but you should expect to pay somewhere between $0.7 - $1.5 million. Included in these legal fees are the preparation of the offering document as well as the review of and advice regarding contracts directly related to the offering. A couple of prominent law firms in the IPO space are Cooley LLP and Wilson Sonsini Goodrich & Rosati.

Auditor – In addition to the year-end audit required by the SEC you will need to hire an auditor to issue a comfort letter to the underwriters, to review the registration statement, to audit the financial statements included in the offering document, and to review all documents related to the offering, such as comment letters from the SEC. Auditor fees are generally within $0.5 - $1.2 million, but, as is the case with most fees related to an IPO, auditor fees can vary depending on the complexity of the offering. The number of issues found by the auditors as well as the length of the comment letter process with the SEC will be reflected in the auditor fees. The largest accounting firms for IPO’s are KPMG, Deloitte, PwC, and EY.

IPO Consultant – In addition to hiring an external auditor, most companies find it necessary to hire a team of IPO consultants to help with IPO preparation and execution. These teams can assist in several ways, including the following:

- Acting as business advisors both to executives and to the audit committee.

- Assisting in the filing of the registration statement, which can include providing help to address the comment letters from the SEC and giving advice related to your financial statements.

- Ensuring the pre-IPO period’s financial information is completed.

- Providing an independent assessment of IPO readiness and aiding in any necessary improvements in preparation for going public.

The fees for this work are broken up into two parts; the more technical accounting related fees range on average from $0.3 million to $0.8 million, while advisory/consulting fees will often range from $0 to $0.5 million. It should be noted that these fees can far exceed the average amounts listed for a complex or large IPO, with fees reaching upwards of $10 million.

Printer – The preparation, distribution and management of marketing materials, the SEC filing, and all other document printing and management needs can create a bill anywhere between $0.3 million - $0.5 million. These specialized services are typically essential to a successful IPO transaction. One of the major printers worth mentioning is RR Donnelley.

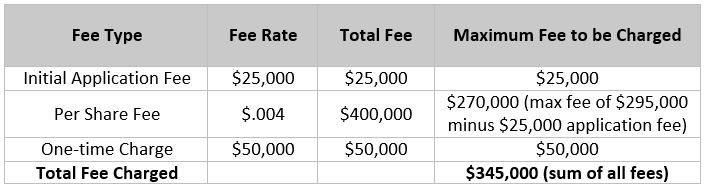

Listing Fees – According to the NYSE Listed Company manual, a company must begin by paying a $25,000 Initial Application fee that will be applied toward other listing fees, a fee of $0.004 per share, and a one-time charge of $50,000 (in addition to the listing fee). The NYSE has stipulated that for first time issuers, there is a minimum listing fee of $150,000 and a maximum fee of $295,000. The following diagram illustrates the application of the NYSE listing fee guidelines for a first time issuer who is issuing a total of 100,000,000 common shares:

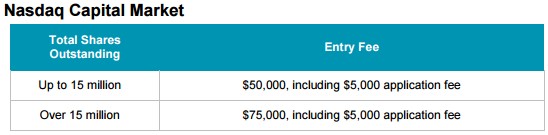

The following diagrams illustrate the NASDAQ listing fees, per the NASDAQ Initial Listing guide:

Registration – The SEC requires a registration fee to file your company’s shares. According to the official SEC website, SEC.gov, this fee can be calculated using a two-step method. Step one directs you to multiply the number of shares to be registered by the proposed maximum offering price per share. This number would then be added to the value of any notes being offered, giving you the aggregate offering price. Step two instructs you to calculate the total registration fee, which is the aggregate offering price multiplied by the current fee rate, which can be found at https://www.sec.gov/ofm/Article/feeamt.html. The following example illustrates this calculation:

Note: The 2017 fee rate of $0.0001159 was used in the example below.

Road Show –The main costs of the road show are the cost of flights, hotels, ground transportation, and any fees related to your chosen venues. According to a representative from EY, a roadshow generally lasts anywhere from 8 days to 2 weeks, and the roadshow team usually consists of the underwriters and the senior management of the filing company. The cost of a roadshow varies greatly as the destination, length, and lavishness of the trip is unique to each company.

Pre-IPO Indirect Costs

Because the registration statement does not require a report of indirect costs, these costs are very hard to reasonably estimate. Additionally, each company has unique needs, so the breadth and depth of indirect costs varies greatly from company to company. This is especially true for restructuring costs, as one company may need very little restructuring while another may need work “from floor to ceiling.” Rather than trying to make an estimate that would not be useful to most companies, the following section will discuss what is involved in each of the related cost areas. This knowledge should help you to make an accurate estimate that will be more representative of your own unique needs.

Restructuring Costs, Including the Audit Committee Charter – The costs required to restructure a company may be incurred as late as a month or two before the filing occurs, or as early as 2-3 years prior to filing. These costs are made up of legal, information technology, human resource, audit, valuation, and financial advisory fees. Some of the restructuring issues to be considered are formation of an internal legal department, a tax department, an investor relations department, an internal audit department and audit committee, the drafting of by-laws, the implementation of new reporting and accounting systems, the creation of new employee benefit plans, and the creation and documentation of internal controls. The amount of time needed for this restructuring and the number of professional services that are required for your specific needs will determine the extent of these costs.

Costs to Make Financial Statements S-X Compliant, Valuation Services and Reports, and Articles of Incorporation – In addition to restructuring costs, you will likely be faced with costs related to valuation services for cheap stock analysis, 409A compliance, and any other necessary valuation; financial statement reviews; and advisory services to aid in creating Articles of Incorporation and ensuring regulation S-X compliance. This may mean the hiring of additional audit, valuation, and financial advisory professionals.

Post-IPO Recurring Costs

According to PwC’s 2015 article titled “Considering an IPO? An insight into the costs post-JOBS Act” (hereafter referred to as the “PwC article”), “Approximately 60 percent of [newly public companies surveyed] spent more than $1 million annually on recurring costs as a result of being public.” This section will cover what contributes to this increase in costs.

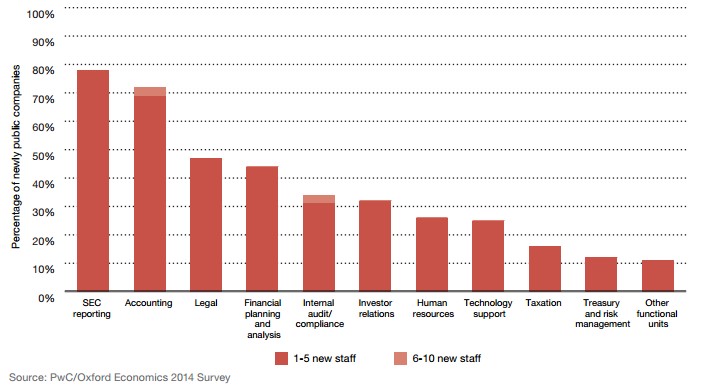

New staffing expenses – In addition to the restructuring costs of forming and organizing new departments, you will be faced with the ongoing cost of hiring, training, retaining, and providing benefits to a number of new employees. Though you may face growth in all departments, it is likely that you will face the most growth in departments that deal directly with accounting, finance and legal issues. The PwC article includes the following diagram, illustrating the areas in a company that most commonly need an increase in staff due to an IPO.

Though the cost for new personnel will vary based on the industry, size, and complexity of your company, the need for planning ahead and being aware of these costs is universal. Proper foresight and planning for staffing expenses can have a big impact on the long-term success of your company as these costs can quickly add up at a time when the company’s profit margins matter more than ever before.

Advisor Fees (Tax, Accounting, Consulting) – There is a great deal of scrutiny from the public as well as from regulators and creditors for a public company. To maintain accurate records and compliance with these third-party requirements, companies find it necessary to hire third-party advisors. PwC did another study that benchmarked the costs of managing a public company, and reported in the previously referenced article found that “financial reporting, regulatory compliance, and incremental auditing costs together accounted for an estimated 52 percent of the total incremental ongoing costs directly associated with being public.”

Other Organizational and Unanticipated Costs – The costs enumerated in this section are by no means an exhaustive list. As has already been stated, there is a great deal of variability in the IPO process, especially as it relates to post-IPO processes and costs. You will likely be unable to predict every cost that will be incurred on an ongoing basis after listing as a public company. PwC reported that about 40% of CFO’s surveyed felt that the costs of being public were more than they had anticipated. Prepare beforehand to face unanticipated costs so that they will not harm your standing with creditors and investors.

Post-IPO One Time Costs

Much of what has been stated regarding recurring post-IPO costs stands true for one-time costs as well. Just as with recurring costs, PwC has estimated that companies will spend on average $1 million on one-time costs, post-IPO.

New Financial Reporting System and Implementing New Controls – Though some of the cost for a new financial reporting system may have already been incurred prior to your IPO, it is likely your company will not be fully integrated into the new reporting system by the time your IPO is complete. These post-IPO costs can include professional accounting advisory fees for implementing internal controls into the new reporting system and IT advisory fees for the installation, implementation and testing of the system.

New Board of Directors – Depending on the makeup of your current Board of Directors, you may need to consider recruiting and hiring additional Board members. As a public company, the Board of Directors takes on many new and significant tasks. Consider the ethical tone of your Board; the capacity of the Board to hire, train, and manage senior-level employees; the Board’s ability to identify and manage risks; the Board’s views on corporate governance; etc. Weaknesses in these areas can lead to problems for your company down the road, so taking the time to structure a strong, well-rounded Board of Directors is essential to the long-term success of your company.

New Compensation Plans – Although the fulfillment and administration of compensation plans is a recurring cost, the creation of stock-based and other forms of compensation plans should be a one-time cost. As with the reporting system, a good deal of the work and costs related to developing new compensation plans may have already been completed and incurred at this point, but these plans have likely not been finalized. KPMG discusses post-IPO compensation plans in their article titled “The-Entrepreneurs-Roadmap,” suggesting that post-IPO compensation plans need to “[position] the company for growth and predictability.” The article establishes that “newly public companies can best approach aligning and optimizing the people costs within a new public entity with…delivering value to shareholders” through a “total rewards strategy” that will “[serve] the needs of all stakeholders.” These plans are an important part of being a public company and should not be overlooked.

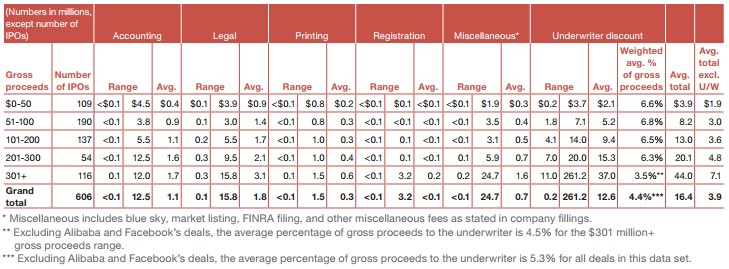

Illustration of the Cost of Going Public by Gross Proceeds

The diagram below provides a range of IPO costs directly attributable to an offering that you could expect to incur based on the gross proceeds of your offering. The diagram comes from the PwC article and is based on an analysis of 600+ IPOs between April 5, 2012, and December 31, 2014.

Accounting for the Costs of an IPO

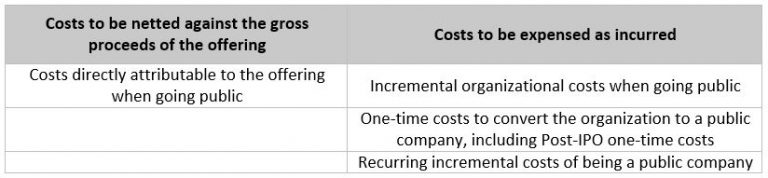

The Financial Accounting Standards Board’s (“FASB”) Accounting Standards Codification (“ASC”) separates the guidance for the costs discussed above into two different sections; ASC 340-10-S99-1 (SAB Topic 5.A) covers the actual expenses of the offering, while ASC 720-15 covers only those costs that qualify as start-up costs. ASC 340-10-S99-1 states that “specific incremental costs directly attributable to a proposed or actual offering of securities may properly be deferred and charged against the gross proceeds of the offering.” In contrast, the remaining costs fall under the guidance found in ASC 720-15, and must be expensed as incurred. Using the guidance found in the codification and the interpretation in the PwC article, the costs can be organized as follows:

Though several costs of an IPO fall into only one of the two categories listed above, many costs will need to be allocated between the two methods. Examples of costs that fall under each of these scenarios are listed below.

Costs to be netted against gross proceeds:

- Underwriter Fees

- Road Show Costs

- Printer Costs

Costs to be expensed as incurred:

- Listing Fees

- Restructuring Costs

- Costs of New Board of Directors

- Costs of Compliance

Costs to be allocated between both methods:

- Legal Fees

- Auditor Fees

- Advisory Fees

Conclusion

The task of going public is significant and justifies an equally significant summation of costs. The information presented here will help you determine a dollar figure to use as you weigh the pros and cons of taking your company public. Once you decide to file for an IPO, knowing and anticipating the costs will help ensure the long-term success of your company in the months and years ahead.

Resources Consulted

General Information

- PwC, Considering an IPO? An insight into the costs post-JOBS Act

- KPMG, A Guide to Going Public

- Torys, The Benefits and Costs of Going Public

Book building and Auctions:

- Forbes, Why Is Going Public So Costly?

- Northwestern, Why Don’t Issuers Choose IPO Auctions? The Complexity of Indirect Mechanisms

Listing Fees:

- An organization such as a pension fund, insurance company, or union that makes large investments.