Accounting for Stock Compensation

This article moves beyond the basics of stock compensation (including stock options) and touches on the accounting complexities associated with stock compensation awards.

After gaining a basic understanding of stock-based compensation (SBC) from our article Stock Options 101, you’re ready to learn how to account for stock compensation. Understanding some of the accounting complexities of SBC will help your company structure stock compensation packages while complying with accounting regulations. This article serves as a starting point for some of the stock compensation accounting complexities you may run into, including classification, measurement, recognition, modification, and disclosure.

How should stock compensation be classified?

Stock compensation comes in many different forms—stock options, restricted stock units (RSUs), stock appreciation rights (SARs), and warrants. Each award can be given to an employee or contractor to supplement or replace monetary compensation. Depending on the characteristics of an award, it may be classified as equity or as a liability, and its corresponding cost may either be capitalized or expensed.

Liability vs. Equity

Stock compensation may be classified as equity or as a liability. Typically, stock compensation classified as a liability is less favorable from an accounting perspective because liability awards must be remeasured at the end of each reporting period, which adds valuation and accounting costs. On the other hand, equity stock compensation may dilute the existing ownership in a company (see our article on Dilution and Stock Option Pools).Stock compensation is generally classified as equity. However, some awards act more like an obligation to a company, such as awards that have the following conditions:

- Cash settlement – The award is settled in cash rather than shares (ASC 718-10-25-11). This usually applies to SARs because SARs can be settled in either shares or cash.

- Repurchase feature – Either the company has the right to repurchase an award and will likely exercise that right or the recipient of an award has the right to sell its award back to the company within six months of when the award is vested or exercised (ASC 718-10-25-9).

- Awards indexed to a non-equity measure – An award’s value is based on a non-equity measure, such as a commodity (ASC 718-10-55-65).

- Underlying stock is classified as a liability – The underlying stock of an option or similar instrument is classified as a liability.

- Other Conditions – The company promises an award at a fixed-dollar value instead of the market value of its shares, or the company allows the recipient of an award to redeem an award only on a specified date or event1.

Expense vs. Capitalization

A company must classify stock compensation in the same way that other compensation is classified for a recipient. Thus, if some or all of a recipient’s compensation is capitalized2, the stock portion of the recipient’s compensation must also be capitalized. Because stock compensation may be expensed or capitalized, it is referred to as compensation cost rather than compensation expense.

How should a company value a stock compensation award?

Depending on the nature of the company and the information available, a company may measure an award using its fair value, calculated value, or intrinsic value.

Fair Value

A company should use the fair value method of determining an award’s value if sufficient information is available to develop a supportable fair value estimate (ASC 718-10-30-2). An option pricing model, such as the Black-Scholes Model or a lattice model, is used to determine the fair value of an award. For more information about estimating the fair value of an award using these models, please see our article Black-Scholes Model.

Calculated Value

A company must estimate its stock volatility as part of the stock compensation award valuation. A nonpublic company may not be able to develop a supportable estimate of volatility if it lacks sufficient historical data. Instead, it may use the volatility of a peer group of companies to help estimate volatility or calculate volatility using an appropriate industry sector index, which summarizes the performance of related companies, grouped together by industry or sector. The volatility estimate is then used in conjunction with other inputs to value an award.

Intrinsic Value

Nonpublic companies have the option to measure an award using the intrinsic-value method for liability awards or for awards that are so complex or unique that the award values cannot be reasonably estimated using the fair value or calculated value methods. The intrinsic value of an award is the difference between the exercise price and the stock price. Under this method, the company must remeasure the intrinsic value at the end of each period, which can be costly because the nonpublic company must revalue its stock each reporting period.

When should a company recognize the cost of an award?

Whereas cash compensation is measured as it is paid, stock-based compensation is measured over a period of time called the requisite service period. The requisite service period begins on the service inception date (generally the grant date3) and ends when the recipient has met the conditions of the award. The requisite service period may be explicitly stated, implicitly determined from the terms of the award, or derived using valuation techniques. Each award has unique conditions and terms that affect when and how an award is recognized.

Service, Market, and Performance Conditions

A stock compensation award typically comes with one or more conditions that must be met before it can be exercised:

- Service Conditions: the recipient must work for the company for a period of time.

- Market Conditions: the company must achieve a certain stock price, or an award must reach a specified intrinsic value4. This condition may require that the company itself achieve a certain stock price, for example, or that it achieve a certain stock price relative to a group of related companies.

- Performance Conditions: the recipient must work for the company for a period of time, and an individual or company-wide performance target must be achieved. A performance target could include obtaining a particular financial ratio, beating the industry average on a given metric, or going through a qualifying event, such as an IPO.

Once the conditions of an award are met, the award may be exercised. An award may have a single service, market, or performance condition or any combination of the three. The requisite service period, timing of recognition, and accounting treatment of forfeitures vary according to an award’s service, market, or performance conditions.

IPOs and Performance Conditions

If an award has a performance condition related to a liquidity event, such as an IPO, the probability of the event’s occurrence must be assessed. Consistent with guidance on assessing the probability of business combinations found in ASC 805-20-55-50 through 55-51, a liquidity event, such as an IPO, is generally not considered probable until it occurs. This is true even if the S-1 has already been filed with the SEC. Thus, no compensation cost is recorded before an IPO for awards with these conditions, and a large booking of compensation cost is then booked after the IPO occurs.

Awards with No Vesting Conditions

In the case that an award will vest even if the recipient no longer works for the company, the vesting condition of an award is considered non-substantive. Consequently, the award does not have a service, performance, or market condition, and the full compensation cost must be recognized on the grant date (ASC 718-10-55-88).

Cliff Vesting vs. Graded Vesting

An award may vest completely at a point in time (cliff vesting) or in increments over time (graded vesting). Compensation cost is recognized on a straight-line basis over the requisite service period for cliff-vesting awards. Awards subject to performance or market conditions must be recognized using a cliff-vesting schedule. For awards with service conditions, a company may choose to recognize compensation cost on a straight-line basis or according to a graded vesting attribution (accelerated) method. In the graded vesting attribution method, an award is divided into vesting increments or tranches, and the company recognizes compensation cost for each tranche separately, on a straight-line basis.

For example, on 1/1/X1 Company EFG offers a compensation package to Employee A and Employee B with the following terms:

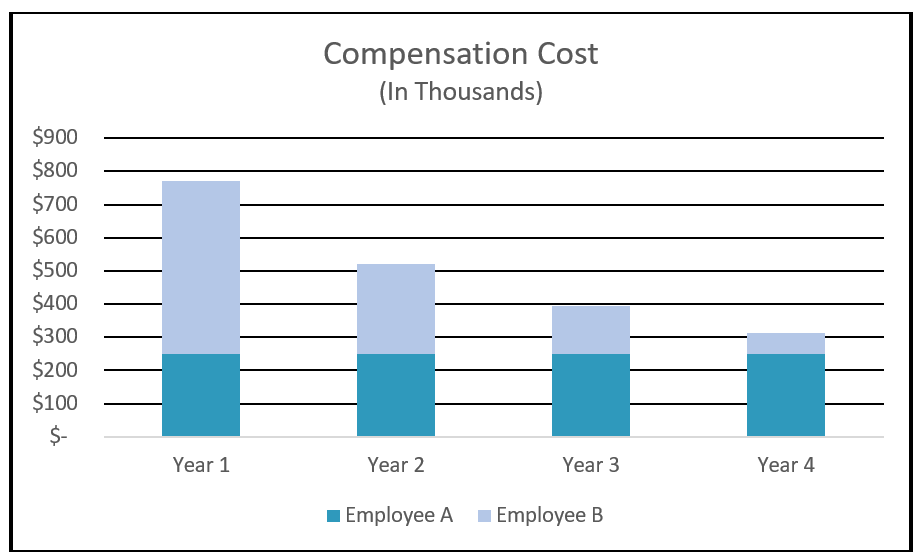

For Employee B, Company EFG has chosen to recognize compensation cost using the graded vesting attribution method. Given these terms, Company EFG recognizes compensation cost for Employee A and Employee B using the following schedule:

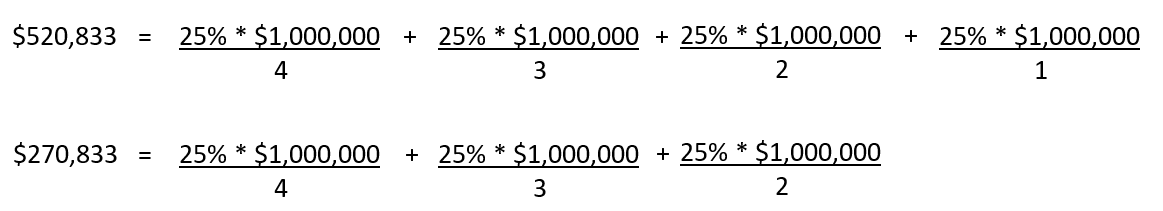

Company EFG recognizes $250,000 of compensation cost each year for Employee A. For Employee B, Company EFG recognizes $520,830 of compensation cost in Year 1 and $270,833 in year 2, which can be computed as follows:

Using the graded vesting attribution method, Company EFG recognized more compensation cost for Employee B in years 1 and 2 but less compensation cost in years 3 and 4.

How do modifications affect the accounting treatment of an award?

An award modification is a change to the terms or conditions associated with an award. Increasing the vesting period, lowering the exercise price, accelerating vesting, reclassifying the award, or increasing the number of shares would all be considered award modifications. Award modifications may have significant tax consequences, such as causing a company to become noncompliant with Section 409A of the Internal Revenue Code, increasing the amount of compensation granted to executives such that it rises above the allowable deductible limit, or causing options to no longer qualify as incentive stock options.

According to ASC 718-20-35-2A, a modified award does not have separate accounting treatment (i.e., modification accounting) if its value, vesting conditions, and classification remain the same before and after the modification. Modifications to an award’s pricing, conditions, terms that affect the classification of an award, or vesting schedule (i.e., accelerated vesting) generally do require modification accounting.

In modification accounting for equity awards, the original award is treated as if it is repurchased by the company, and a new award is granted to the recipient. As modifications typically increase the value of an award, the company must recognize additional compensation cost for the incremental benefit. This is recognized immediately for a vested award or for the vested portion of an award if using a graded vesting schedule. Compensation cost is recognized over the requisite service period for the unvested portion of an award.

For a liability award, the original award is still exchanged for a new award, but because liability awards are remeasured at each reporting period, it will simply be recognized at fair value at the modification date. The date at which a modification occurs will impact the timing of compensation cost recognition.

What are the disclosure requirements for stock compensation awards?

ASC 718-10-50-1 outlines the four main elements to be addressed in a company’s stock-based compensation disclosures:

- The nature and terms of such arrangements that existed during the period and the potential effects of those arrangements on shareholders

- The effect of compensation cost arising from share-based payment arrangements on the income statement

- The method of estimating the fair value of the goods or services received, or the fair value of the equity instruments granted (or offered to grant), during the period

- The cash flow effects resulting from share-based payment arrangements

ASC 718-10-50-2 then proceeds to list the “minimum information” that a company must disclose to meet the above requirements. The required minimum information is quite lengthy, and this article does not mention every aspect of the required disclosures; we will simply note that companies are required to disclose the details of an award’s terms and conditions, the number of shares outstanding, and modifications, among other things. A company must also disclose which method it used to calculate the fair value of awards as well as significant assumptions used in the process.

For interim reports, ASC 718 does not explicitly require any disclosures related to stock-based compensation if the stock-based compensation does not have a material impact on the financial statements. A company will often grant a large percentage of its awards at a single time each year. Thus, the interim report that contains this period will likely be the only interim report that includes detailed disclosures related to stock compensation.

Conclusion

Stock compensation is used frequently to compensate employees and to better align the incentives of the company and its employees. Understanding the accounting complexities surrounding stock compensation will help you better structure stock compensation packages and stay in line with GAAP accounting. While this article touches only the surface of some of the accounting complexities related to accounting for stock compensation, the Big 4 guides and other resources listed below dive deep into the accounting issues mentioned in this paper.

Resources Consulted

- ASC 718-10-25-9, 718-10-25-11, 718-10-25-15, 718-10-25-20, 718-10-30-2, 718-10-30-14, 718-10-35-3, 718-10-35-6, 718-10-50-1 to 50-2, 718-10-55-65, 718-10-55-88, 718-10-55-108, 718-10-55-131, 718-20-35-2A, 805-20-55-50 to 55-51

- PwC: Stock-based compensation

- PwC: Financial statement presentation

- EY: Share-based payment

- Deloitte: A Roadmap to Accounting for Share-Based Payment Awards

- Under certain conditions, this may not apply to nonpublic entities (see ASC 718-10-55-131).

- When an item is capitalized, it is initially recorded as an asset and is expensed later as the asset is depreciated or amortized.

- In practice, defining the grant date can be complex and is an area of heavy audit focus.

- The intrinsic value of a stock is the stock’s market price less the exercise price. Thus, a condition may require that the market price reach a certain level above the exercise price before it can be exercised.